idaho state capital gains tax rate 2021

Idaho conforms to the IRC as of January 1 2021. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Idaho Tax Forms And Instructions For 2021 Form 40

In Idaho the uppermost capital gains tax rate was 74 percent.

. Even with these tax cuts that remains on the higher side of all the rates in the country. With Rbi Keeping Interest Rates On Hold Quantitative Easing To Unfold Fitch Times Of India In 2021 Bank Of India Times Of India Icici Bank Share this post. The Freedom Foundation a conservative advocacy group filed a lawsuit against the state of Washington and the state Department of Revenue on behalf of state residents including an East Wenatchee man.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Short-term gains are taxed as ordinary income. One important thing to know about Idaho income taxes is that Social Security income is not taxable.

The capital gains rate for Idaho is. Capital Gains Deduction and Instructions 2021 approved Author. Tax Rate.

The 2022 state personal income tax brackets are updated from the Idaho and Tax Foundation data. Maximum capital gains tax rate for taxpayers with income above 459750 for single filers 517200 for married filing jointly. Plus 6625 of the amount over.

Capital Gains and Dividends Taxes. Plus 3625 of the amount over. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property.

Plus 4625 of the amount over. Federal outlays to state government 2014-2017 State tax revenue projections and shortfalls 2020-2021 Proportion of state government general revenues from. 2021 federal capital gains tax rates.

Capital Gains Tax in Idaho. 800 972-7660 Hearing impaired TDD 800 377-3529 taxidahogovcontact EIN00070 09-15-2021 Page 2 of 2 f. Capital gains for farms is.

This means that different portions of your taxable income may be taxed at different rates. The combined uppermost federal and state tax rates totaled 294 percent ranking tenth highest in the nation. Income and Payroll Taxes.

Idaho State Tax Commission. Congress Passes 900 Billion Coronavirus. Plus 5625 of the amount over.

EFO00093 09-15-2021 Form CG Capital Gains Deduction 2021. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets. Installment sale isnt eligible for the Idaho capital gains deduction if the property wasnt held for the.

The idaho state sales tax rate is 6 and the average id sales tax after local surtaxes is 601. Zero percent 15 percent or 20 percent. Plus 1125 of the amount over.

In the Boise area. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Individual income tax rates now range from 1 to 65 and the number of tax brackets has been reduced from seven to five.

Newer Post Older Post Home. Tax Rate Reduction Effective January 1 2021 all tax rates have been decreased. Learn about Idaho tax rates rankings and more.

Plus 3125 of the amount over. The Senate Bill 5096 took effect in January 2022 and levied a 7 tax on capital gains exceeding 250000. State and Local Sales Tax Rates 2021.

Idaho State Single Filer Personal Income Tax Rates and Thresholds in 2022. Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale. Idaho State Tax Commission.

Enter the smaller amount here and on Form 39R Part B line 10 or Form 39NR Part B line 6. Idaho tax forms are sourced from the Idaho income tax forms page and are updated on a yearly basis. Idaho has enacted several tax cuts in the past decade lowering rates for top earners from a rate of 780 in 2011 down to the current rate of 650 for the 2021 tax year.

During the waning days of the 2021 legislative session lawmakers altered the ability of municipalities to adjust their budgets based on new growth. Idaho state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625 and 6925 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The Idaho tax rate is unchanged from last year however the income tax brackets.

Short-term capital gains come from assets held for under a year. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap.

Long-term capital gains come from assets held for over a year. The Idaho State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Idaho State Tax Calculator. The percentage is between 16 and 78 depending on the actual capital gain.

Tax Expenditures Credits and Deductions. Idaho doesnt conform to bonus depreciation for assets acquired after 2009. The tables below show marginal tax rates.

Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Maximum capital gains tax rate for taxpayers with income above 41675 for single filers 83350 for married filing jointly. Page 1 of 2.

For example a single. Idaho state capital gains tax rate 2021 Sunday February 27 2022 Edit. 208 334-7660 Toll free.

Explore data on Idahos income tax sales tax gas tax property tax and business taxes. Idaho State Single Filer Tax Rates Thresholds and Settings. This is your Idaho capital gains deduction.

State Tax Calculator Factory Sale 56 Off Www Emanagreen Com

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Lowest Highest Taxed States H R Block Blog

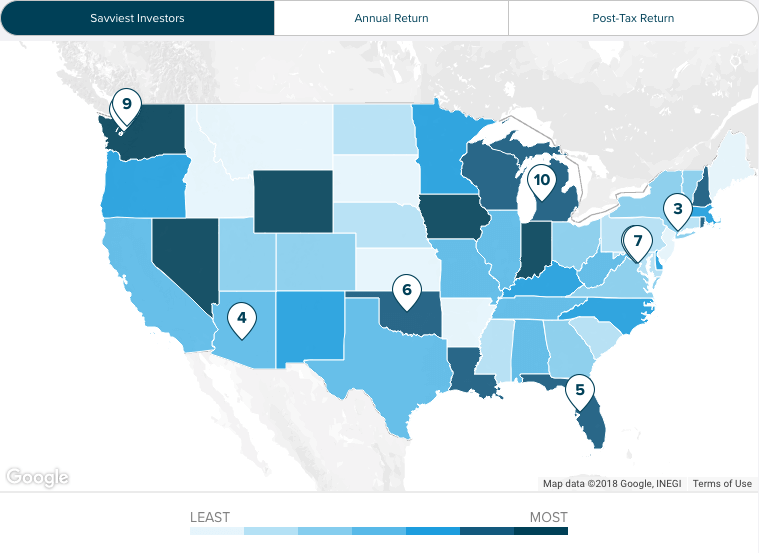

The States With The Highest Capital Gains Tax Rates The Motley Fool

How High Are Capital Gains Taxes In Your State Tax Foundation

Sales Tax On Grocery Items Taxjar

Multi State Tax Issues Arising From Working Remotely

States With Highest And Lowest Sales Tax Rates

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Historical Idaho Tax Policy Information Ballotpedia

2022 State Income Tax Rankings Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

1031 Exchange Rules Success Stories For Real Estate Investors 2021 Real Estate Terms Real Estate Investor Real Estate

2021 Capital Gains Tax Rates By State Smartasset

State Taxation As It Applies To 1031 Exchanges

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com